It’s Best to Remember

Happy Day of the Memorials!

I have so many to remember, and believe me, I do.

Humbly.

Sketch by me as I’m fooling about with the Skitch app for my iPad.

Happy Day of the Memorials!

I have so many to remember, and believe me, I do.

Humbly.

Sketch by me as I’m fooling about with the Skitch app for my iPad.

Been reading up on this whole Facebook IPO debacle.

Oh so very ugly.

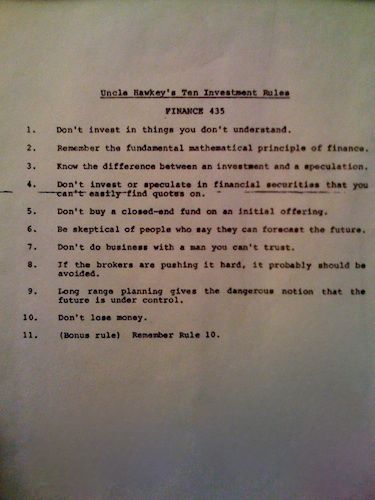

As I think about it, I am reminded of my old NMSU Finance professor Dr. Hawkins, and his Ten Investment Rules.

And so…my official comment on the FB disaster?

Keep #5 always in mind. And #7 too.

Originally posted December 29, 2010

________________

Sometimes, the cranky old man is the smartest man in the room

Back in the good ol’ days, that wild time known at the 1980’s, I was full of youthful optimism, and I was attending New Mexico State University.

My undergraduate major was Finance.

Ooh, those were heady days when I wanted to be a stockbroker when I grew up. This was back before I realized that “stockbroker” and “salesman willing to sell underperforming securities to your family in order to make commission” were synonymous.

While the dream was still alive, I took courses at NMSU from some really fine professors with a lot of experience.

Among them, several courses with Dr. Lowell Catlett, now the Dean of the College Of Agriculture, and a noted expert on futures trading.

There was also both undergrad and grad level classes with Dr. Clark Hawkins, a man who had actually worked as a commodities trader on the NYSE floor. In his words, he had tried pretty much every investment vehicle out there…and lost money on ’em all.

Dr. Hawkins was a strange little man. Wiry, small of frame and nasally of voice. He referred to himself as “Uncle Hawkey.” He often told us that, as Finance students, we should have our Wall Street Journal under one arm and our financial calculator under the other.

And this was to be done while wearing a t-shirt imprinted with “Uncle Hawkey’s Ten Investment Rules”.

At the end of each semester, he gifted us with a copy of the ten rules.

Recently, I was searching around in all the old boxes under my house, picking through my crap looking for things I can sell on eBay.

How ironic, then, that I should come across my framed copy of Uncle Hawkey’s Ten Investment Rules in my search for something to sell for money.

Well, I sat down and read the rules.

Goddamn if Uncle Hawkey wasn’t right. He was right then. He’s right now. Right is right.

Now…snap your Wall Street Journal in place, put your finger over the “future value” button on your financial calculator and get set.

Uncle Hawkey’s Ten Investment Rules:

1. Don’t invest in things you don’t understand.

Ah, every single customer of Bernie Madoff…take note!

2. Remember the fundamental mathematical rule of finance.

You know what? I don’t.

I suspect this was about future value and present value of money. He was a stickler on that.

Because I understood and could calculate time value of money, I kicked the salesman’s ass when I bought my first car.

I got that salesguy demoted because he was such a dunce. Thank you Uncle Hawkey.

3. Know the difference between investment and speculation.

Oh I remember this one. I rant about this one. A lot.

Let me just say his own words, with the same shouting nasal tone…

INVESTING IN THE STOCK MARKET IS THE SAME AS GAMBLING!

If you do not think putting your money in the stock market is gambling, then you need to re-examine yourself and your money.

Sure, it may return better odds than Vegas, but not always.

For those of you wailing and gnashing your teeth in the current economic downturn because you had all your money in the stock market, I suggest you get this rule tattooed on your arm and look at it daily.

4. Don’t invest or speculate in financial securities that you can’t easily find quotes on.

Dangling participle notwithstanding….Uncle Hawkey was right.

Once again, I’m looking at you friends of Mr. Madoff….paging investors of Mr. Madoff….

5. Don’t buy a closed end fund on initial offering.

Oh yes, everyone gets oh so very excited about IPO’s. Especially during the dot com boom of the early 2000’s.

Look how well that worked out for most people.

Right.

But Uuuuuncle Haaaawwwkkkey, people in his class would wail…what about _____ and they’d name some company.

And by tracking the history of the stock price, he’d show them how they were wrong. How the price would be driven up on IPO and would, over time, settle back down.

He recommended waiting out an IPO for a company you liked, and buying the shares after the initial flurry of the IPO wore off and the stock had settled down.

6. Be skeptical of people who say they can forecast the future.

Well, if more folks did this, then people like Jim Cramer would be a lot less interesting, wouldn’t they?

7. Don’t do business with a man you can’t trust.

Too true. I would also substitute “man” with “company.”

(And for 2012 I would substitute “man” with “egomaniacal manchild“)

And yet…how many of us do anyway? (*coff* AT&T *coff* Comcast *coff*)

Honestly…it’s getting a lot harder to find honesty these days.

8. If the brokers are pushing it hard, it probably should be avoided.

So simple. So true. Yet….

Paging followers of Mr. Madoff!

(seeing a trend here?)

9. Long range planning gives the dangerous notion that the future is under control.

Oooh, this one hurts.

Remember how great things felt in, oh, say mid-2008? When we all had some money and maybe a big mortgage on a great house and the financial future looked, well…bright?

Yeah.

I broke this one. Uncle Hawkey, wherever in the world you are now, I give it up to you.

You knew. You always knew.

10. Don’t lose money.

Well sh*t. I broke this one too.

However. Slowly but surely, it’s coming back.

Because Uncle Hawkey warned us about short term and long term.

My wise investments will, eventually, find their way home.

And finally….

11. (Bonus rule) Remember Rule 10

Fair enough.

And so…as we slowly but surely dig our way out of these ugly financial times…

May we all remember Rule #10

Thank you Uncle Hawkey.

As a post script…

In my senior year of undergrad, Uncle Hawkey decided to go on a sabbatical from teaching.

He invited us, the students that he had so tortured, to join him for happy hour at El Patio. Ah, that venerable old Mesilla Plaza bar (former home office of the Butterfield Stage).

Uncle Hawkey slapped down a credit card and said we could have all the beer we wanted. Nothing else. Only beer.

Oh, the pitchers flowed that day, and Uncle Hawkey paid for it all.

Maybe all of us college students were, on that day, a good investment.

So, I’m back in the office after a week in Costa Rica. UK Boss is in country. The pace is back to normal. Whatever that means.

Today I sat down with the boss for a much needed, long over due one-to-one session.

It was about halfway through our hour chat that Boss Man said the words that chilled my soul.

“Right, so I just got the schedule for annual reviews. You’ll need to communicate dates to your staff. Self assessments are due by mid-June.”

Just like that. That’s all he said. Easy, breezy and calm.

Meanwhile, the sound of screeching demons and terror howls echoed in my mind.

Yes, it’s that time of year: Performance reviews.

I’ve been doing this manager gig for most of a decade, and still, performance reviews are the hardest thing I have to do every year.

Mainly because I don’t just blow them off and write canned phrases. I actually put in a lot of work on my performance reviews for my team.

I give performance reviews the way I wish they were done for me.

But never are.

That said, just because I care about them. Just because I put in effort. Just because they matter does not mean I actually enjoy writing them.

It’s hard work. Add to that, since I am a middle of the pack manager and not the big boss, I don’t get the set the raises and bonuses. I give input on my team but someone else makes the budget.

So I get to convey raises and bonuses that someone else has decided.

And they so rarely match what my employees deserve.

So I have to write a performance review to match the budget and not the actual performance of the employee.

Often, this can be the least gratifying thing I do all year.

That said, performance reviews are one of the things that separate the wheat from the chaff, the men from the mice, the mangers from the dilettantes.

Writing and delivering a meaningful performance review is what makes me a better manager. I think.

Oh, and in other news, my boss attended some up with people type of training class last week. I said to him “Hey boss, I’m having a problem with this risk assessment.”

“No Karen, as I just learned in my training, there are no problems, only opportunities.”

The fact that I didn’t take that opportunity to kick him in the shins shows the power of my personal and professional growth over the last year.

I’m sure that will show up as a positive on my performance review this year.

Opportunities my ass…….

For my week in Costa Rica, this was the view out of one of my hotel windows.

It cheered me greatly, though I had to look up what pongámosle meant.

It means “give me.”

How utterly charming!

Yes, Costa Rica, I shall give you my green heart. And you shall give me yours too.

Photo copyright 2012, Karen Fayeth, and subject to the Creative Commons license in the far right corner of this page. Photo taken with an iPhone 4s and the Hipstamatic app.

Turns out world traveling makes me homesick more than ever for my homestate.

When I can’t pay my Fair New Mexico a visit in person, I have to go there in my mind.

A good book helps on that transcendental journey.

Time for a re-blog. This was first published May 16,2007.

________________________________

I’m a fan of books, always have been. I have to say that The Flamenco Academy (chronicled here a few days back) has really fired me up lately. I haven’t read a book in a long while that made me feel like there is hope for popular fiction. And that a book set in New Mexico was so well done makes me double happy.

So I know this has been covered plenty of places elsewhere, but here’s my top five list of the best works of New Mexico fiction. These are the books that, in my opinion, make me proud to be a New Mexican.

Without further ado (in no particular order):

1) Red Sky at Morning by Richard Bradford

This is a quintessential read for anyone living in New Mexico. It ranks not just as one of my fave NM books, but one of my fave books of all time. The main character, Josh is brought from Alabama to New Mexico by his parents and is introduced to the clannish people of Northern New Mexico, including the bully Chango. The scene where he and his buddy get liquored up remains a classic. I almost always quote from it when I, myself, tie one on. A classic, truly. And an easy choice for the list.

2) Bless me Ultima by Rudolfo Anaya

One of those books that gave me a wry smile as I read it. One of those where you nod as you read, thinking “yeah, that’s familiar”. Anaya is a beautiful writer and it is an honor to be a fellow New Mexican with a man of his caliber. This coming of age story is a nice contrast of old vs new, how Hispanic culture rolls into American culture in a way that is beautifully unique to New Mexico. It’s lyrical in the storytelling and a must read.

3) The Milagro Beanfield War by John Nichols

Yeah. This had to be here. You know it did. When I’m homesick I put on the movie to see the land as much as anything. It’s a salve for my soul, always. The book was a little tough for me to get through, but worth the effort. It really captures the feeling of that time in New Mexico in the 1970’s. It also captures a little bit of that magic that can only be found on My Fair home state. Milagro Beanfield War always takes me right back home, effortlessly.

4) Cavern by Jake Page

A thriller about a group of spelunkers who explore a hidden cavern and discover a near extinct species of bear…who is none to happy to be bothered. Not a particularly great novel by most standards, but it does speak to a bunch of interesting things including a fairly detailed explanation about how the caverns, including Carlsbad Caverns, were formed. Both my parents worked for a while at the WIPP site, so this book also showed the ongoing battle of all the government agencies involved out there. DOE, Environmental groups, BLM and private interests do war daily and there is some discussion of WIPP in the book and how it may affect things in that geographic area.

My mom turned me on to this book and laughed at how true to life some parts of the book were portrayed. Working at WIPP left her a bit…scarred…so it was good for her to see it in print. Validating, you know? For me, it was a fascinating read and name checked a lot of places I know from living in Carlsbad, including some truly dive bars (including the one frequented by miners, ranchers, roughnecks and college kids. They stopped serving beer in bottles because there had been too many fights. But on a good night, the dancing was unbeatable).

5) Anything for Billy by Larry McMurtry

Ok, not technically a New Mexico book but about a New Mexico legend (Feh to the Texas town that claims ownership. FEH! I say!) and certainly New Mexico figures into the story. I am a massive fan of McMurtry and this is my favorite of all his books. He portrays Billy as a young, impulsive, spoiled, petulant brat. It’s fabulous. To me it was a fresh look at an old legend and to do that takes a talent that Mr. McMurtry has in spades.

You’ll note my list is strangely devoid of Hillerman books. I’m actually not a fan. My mom is an avid reader of his stuff. I am not. : shrug : I’ve got no issues with Hillerman, it’s just not my taste.

Lois Duncan is another author I’m proud to know is New Mexican. As a kid I avidly read all her stuff. Loved her writing and always got geeked out when we saw her at the Coronado Club at Kirtland Airforce Base. My mom would point her out to me. Her husband worked at Sandia Labs like my dad so she’d wait there (like we did) for her husband to get off work. Those were fun sunny summer days as a family. I tend to associate Duncan with that time in my life.

I know there are probably a bunch of good choices I’m missing, but for now, that’s my list. I reserve the right to add, delete and change the list as we go.